At the 2014

Association of Financial Professionals Annual Conference in Washington D.C.

there were a number of incredibly insightful sessions. Perhaps the most interesting, at least on the

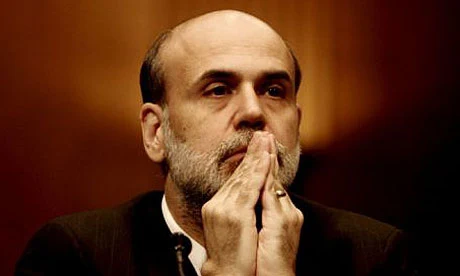

playbill, was the opening general session, which featured Ben Bernanke, the

former chairman of the Federal Reserve.

Bernanke is on tour

selling his upcoming 2015 book, a

memoir focused on his front row seat and actions during the Financial Crisis, for which he has received an advance of roughly $8 million.

He took the

opportunity to speak to over 5,000 members of the AFP, ourselves included, on

November 2, 2014 in Hall E of the Walter E. Washington Convention Center in

Washington, DC.

Bernanke addressed the

audience for approximately 30 minutes in what, for the most part, appeared to

be an apologetic for the actions of the Federal Reserve and other major actors

who found themselves in the middle of the Financial Crisis.

The final 60 minutes

of the session were much more interesting as the presentation changed in format

to that of an interview conducted by Bernanke's friend and former Princeton and

Federal Reserve Colleague, Alan S. Blinder. We will have more

insights from Blinder later in this series of AFP sessions on The Mint.

You can hear a large

portion of the conversation between Bernanke and Blinder by clicking on the

audio file at the link below:

On AIG: At minute 11:30 - Bernanke observes that the

only "True Bailout" performed by the government during the Financial

crisis was that of AIG. He observed that

AIG was like an unregulated hedge fund.

They doubled down by taking the cash they received from insuring the CDO's

against the risk of default and purchasing those same CDOs, essentially leaving

them with double exposure to the CDO market.

There was a sense that they were either not doing proper risk management

or that their actions were cynical.

Bernanke was most irritated by the AIG bailout of all of the actions

that were taken to stave off the Financial Crisis.

On His scariest moment during the crisis: The Tuesday that they

went to Congress to propose TARP when some of the largest firms under pressure.

Not unsurprisingly, Bernanke maintains

that TARP was good policy under the circumstances, and it gave the Fed the

legal authority to take many of the actions that, in Bernanke's opinion, staved

off the total collapse of the financial system.

On Lehman Brothers: There was no legal way

to save Lehman Brothers. At 7:00 he

addresses this. There was not buyer for

Lehman Brothers, and at the time, everybody was pulling away from Lehman, and

the firm would have collapsed with a week anyway.

On Quantitative Easing: At minute 16, Blinder

brings up the fact that Bernanke lobbied for a time for the series of programs

which were known as "Quantitative

easing" to be called "Credit easing" in order to distinguish it

from the actions previously taken by the Bank of Japan. The key difference being that while the Bank of

Japan pumped funds directly into the banks as reserves, the Fed was creating

liquidity to the system as a direct actor in the credit markets.

{Editor's Note: Those interested in satire can see our 2010 rendition of the Bare Naked Ladies hit If I had a Million Dollars as sung by Ben Bernanke, inspired by the early rounds of QE here}

{Editor's Note: Those interested in satire can see our 2010 rendition of the Bare Naked Ladies hit If I had a Million Dollars as sung by Ben Bernanke, inspired by the early rounds of QE here}

On the stock vs. flow theory: Around minute 21,

Blinder and Bernanke move into a conversation about the "stock"

versus the "flow" view of the Fed's balance sheet. The key difference being that those holding

the stock (meaning money stock) view look at the Fed's balance sheet as it

actually is to infer the effects that the Fed is having on monetary policy,

while those that hold to the "flow" view, namely almost everyone on

Wall Street, look at the Fed's buying and selling of assets to infer the

effects.

Bernanke is a strict

adherent to the stock view, and wonders what will happen if and when the Fed

looks to unwind its Balance sheet at a future date.

For those who followed

the Financial Crisis closely, Bernanke offers his own, less guarded take of the

events in the interview, which we assume will be a precursor for the contents

of his upcoming memoir.

One of the stark

takeaways that we are compelled to pass on to our readers is the

following: Bernanke's assertions that

the Fed did not have the legal authority to save the financial system until

TARP was passed. TARP was essentially

railroaded through Congress on the advice of then Treasury Secretary Henry

Paulson. While it may have been the

expedient thing to do at the time, it is unclear whether it was a good idea to

give the Federal Reserve and the Treasury (for they work in tangent with one

another) the authority to backstop the financial system.

It is a question that

is still waiting to be answered today, on the eve of yet another great

inflation event.

Stay Fresh!

David Mint

Key Indicators

for November 23, 2014

Corn Price per Bushel: $3.72

10 Yr US Treasury Bond: 2.32%

Bitcoin price in US: $367.00

FED Target Rate: 0.10%

Gold Price Per Ounce: $1,282

10 Yr US Treasury Bond: 2.32%

Bitcoin price in US: $367.00

FED Target Rate: 0.10%

Gold Price Per Ounce: $1,282

MINT Perceived Target

Rate*: 0.25%

Unemployment Rate: 5.8%

Inflation Rate (CPI): 0.0%

Dow Jones Industrial Average: 17,810

M1 Monetary Base: $2,758,900,000,000

Unemployment Rate: 5.8%

Inflation Rate (CPI): 0.0%

Dow Jones Industrial Average: 17,810

M1 Monetary Base: $2,758,900,000,000

No comments:

Post a Comment